Starting a business in Sierra Leone presents an exciting opportunity for entrepreneurs seeking to tap into the expanding markets of West Africa. The process of establishing a business is relatively simple, typically taking about 2-3 weeks to complete. With clear procedures, affordable costs, and well-defined legal requirements, Sierra Leone offers a favorable environment for both local and international entrepreneurs aiming to establish a presence in the region.

Types of Business Entities in Sierra Leone

The first step in registering a business in Sierra Leone is selecting the appropriate business structure. The country offers various options, each catering to different business needs:

- Limited Liability Company (LLC): A popular choice for small to medium-sized businesses, providing limited liability to shareholders.

- Partnership: A business structure where two or more individuals share ownership and responsibilities.

- Public Limited Company (PLC): Suitable for larger businesses intending to raise capital by offering shares to the public.

- Branch Office: A business extension of an existing company from abroad.

- Company Limited by Guarantee: Often used for non-profit organizations or charities.

- Sole Proprietorship: A business owned and run by one individual. Recommended for locals only.

Steps for Business Registration in Sierra Leone

Starting a business involves several key steps to ensure that your company is legally recognized. Here is a step-by-step breakdown of the registration process:

Step 1 – Check the Uniqueness of Your Business Name

To start the registration process, you must first ensure that your business name is unique. Conducting a name search at the Office of the Administrator and Registrar General (OARG) will confirm whether your chosen name is available or not. The cost of conducting the name search is SLL 20,000.

Step 2 – Complete the Registration Form

After confirming the availability of your business name, the next step is to complete the registration forms. There are specific forms to complete depending on the type of business you want to register. These forms can be accessed at the OARG or online https://oarg.gov.sl/business-register/. When registering a business in Sierra Leone, the following are some of the information and documents needed to complete your business registration application.

- Business Name

- Registered Office Address

- Tax Identification Number (TIN)

- Business Contacts (Telephone number, email address, and postal address)

- Directors’ and Shareholders’ Names & Addresses

- Company Secretary & Auditor’s Names and Address

- Share Capital (Minimum share capital for a private company is Le 1,000,000)

Step 3: Register with the Registrar of Companies.

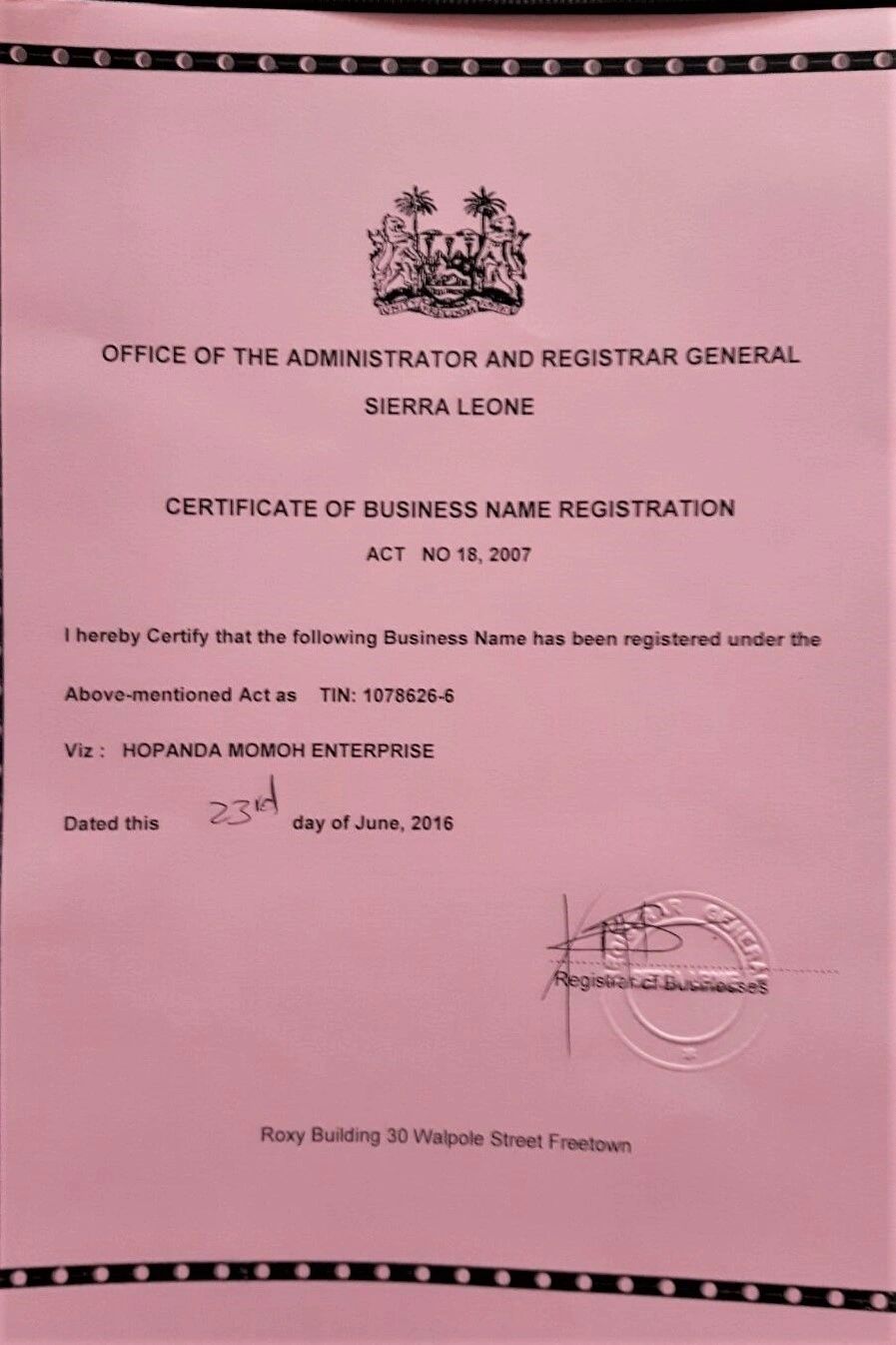

In Sierra Leone, the company registration process is done through physical submission of documents at the Office of the Administrator and Registrar General (OARG). While certain forms are available online, the actual submission and verification of your documents happen in person at OARG. You will need to visit the OARG office to complete your registration and provide any necessary documentation. Once your company is successfully registered in Sierra Leone, you will receive several important documents. These include the Certificate of Incorporation, which officially confirms that your business is legally registered. This document will have details such as your company name, registration number, and the type of entity you have established.

Step 4 – Obtain Tax Identification Number

All businesses in Sierra Leone must be registered with the National Revenue Authority (NRA) to obtain a Tax Identification Number (TIN), which is a mandatory requirement for all businesses. The TIN is essential for tax purposes and ensures compliance with the country’s tax laws.

Step 5 – Request a Business License

Businesses must apply for a business license from the local municipality where the business will be operating. For businesses in Freetown, the process is handled by the Freetown City Council. The business license certifies that the business is legally allowed to operate within that municipality.

Step 6 – Register with the Ministry of Labor and Social Security

For companies employing local workers, registration with the National Social Security and Insurance Trust (NASSIT) is required. This ensures that employees are registered for social security benefits and other related programs.

Step 7 – Make a Company Seal

The Companies Act mandates the creation of both a formal and common seal for all companies. A formal seal is used for documents meant for international use, while a common seal is used for domestic documents. The cost of making a company seal is SLL 50,000.

How much does it cost to register a company in Sierra Leone

Several fees are associated with the registration process. These include:

Name Search: SLL 20,000

Incorporation Fee: No more than SLL 60,000 (one-time fee)

Stamp Duty: Ranges from SLL 75,000 to SLL 495,000 depending on the company’s share capital

Written Statement Fee: SLL 50,000 (required by the Finance Act 2015)

Tax Identification Number (TIN): SLL 750,000

Company Seal: SLL 50,000

Cost of services at Office of the Administrator and Registrar General

Aside company registration cost, for individuals registering sole proprietorship and partnerships, there are separate charges for that. There are also separate charges for other post incorporation activities you may carry out at the OARG.

| Sole Proprietorship | Le 220.00 |

| Partnership | Le 300.00 |

| Change of Name | Le 150.00 |

| Certified Copy | Le 100.00 |

| Change of Address | Le 150.00 |

| Change of Business Nature | Le 150.00 |

| Open of New Branch | Le 150.00 |

| Annual Returns Filling Fees | Le 50.00 |

| Closure of Business | Le 50.00 |

| Search/Verification | Le 50.00 |

Conclusion

Registering a business in Sierra Leone is a straightforward process with clear steps to follow. All businesses are required to be officially registered and obtain a Certificate of Incorporation, which must be displayed at the principal place of business. By following the proper legal steps and ensuring compliance with local laws and regulations, entrepreneurs can successfully establish and operate businesses in Sierra Leone, contributing to the growing economy and opening new opportunities for trade and investment.

Whether you are starting a sole proprietorship or a larger limited liability company, Sierra Leone offers a business-friendly environment that encourages growth and expansion. With a simple and efficient registration process, the country presents a great opportunity for both local and international entrepreneurs looking to invest in the region.

You may also read on business registration in Senegal