Are you doing a transaction in Ghana with a local business entity? Whether it is an arms-length trade transaction or a one on-one-transaction, the importance of background due diligence checks cannot be overemphasized.

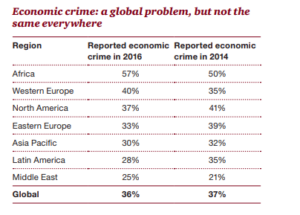

More than a third of organizations have experienced economic crime in the past 24 months, as reported by over 6,000 respondents to PwC’s Global Economic Crime Survey 2016. Sadly, most corporate fraud is detected only by accident. Therefore, it is imperative to invest in external agencies to undertake background due diligence checks, vendor verification, one of the major leaks in revenue loss.

Today, more than ever before, a passive approach to detecting and preventing economic crime is a recipe for disaster. There appears to be a widespread lack of confidence in local law enforcement and hence the burden of preventing, protecting and responding to economic crime rests firmly with organizations themselves.

What’s more, one in five organizations (22%) have not carried out a single fraud risk assessment in the last 24 months. In fact, findings indicate that one in ten economic crimes are discovered by accident.

Source: Global Economic Crime Survey 2016 by PwC

In Ghana the story is no different; recent news feeds and research reports indicate that the rate of document fraud and falsification is on the ascendancy. Tax clearance certificates, driver’s license, SSNIT clearance, academic qualification certificates, company’s registration certificates and company profiles are being doctored.

See the stories below;

In our experience, there have been instances where persons transacting businesses have been shown pictures and even taken to specific property sites only to realize that the seller did not hold title to those properties. Similarly, others have been shown images of goods/materials etc. on sale and even sometimes taken to warehouses only to realize yet again that the seller did not have the right to sell those goods.

How do you tell if a company’s registration certificates and business profile are genuine? How can you distinguish between a fake or forged work/residence permit submitted by an expatriate or even a tax clearance certificate? How then can you also tell if a person holding himself out as an officer of a company is indeed with the company? Several of these questions linger on and without asking the right questions and looking in the right places, you may find yourself in one of those several scams happening around. A common phenomenon quiet recently is to receive emails from persons who promise you government contracts and even sometimes show you contract award letters.

In the ever-sophisticated marketplace with advanced technology systems, fraudulent documentation is on the rise. Several organizations have fallen prey and contracts turn into litigation due to this phenomenon.

In Africa and Ghana, the risk is even higher, therefore in all you do, confirm, authenticate and verify the genuineness of contract documents, permits, licenses, authorizations before you make the business decision and protect your firm from legal, financial and reputational risks associated with transactions.

What to do to reduce the risk of fraud in transactions in Ghana

- If you are dealing with a business entity, please check the legal status of the company

- Make sure the person you are dealing with is indeed an officer of the company and has the capacity to transact business.

- If the transaction involves the sale of asset/goods/property, check to confirm the person or entity has title to the asset or property and the assets physically exists.

- If the transaction involves the sale of asset/goods/property; after the seller shows you the asset/goods/property try to visit the same location again by yourself and ascertain the environment, talk to neighbors and relevant persons.

- Resort to relevant Ministries, Departments, and Agencies of Government to authenticate and validate all documentation.

- In some instances especially landed property, undertake checks from multiple agencies to ascertain the validity of the search report.

- Check also if the assets on the asset register or the financial statements do exist.

- Be sure the annual financial statements of the company has been dully audited by a reputable auditing firm in good standing and also submitted to the Ghana Revenue Authority.

- If the transaction involves the sale of asset/goods/property, be sure again that the asset/goods/property has no lien, litigation or previously used as collateral on a credit facility.

- As much possible try to negotiate payments terms that are tied to specific events or landmarks. Avoid contracts that require 100% upfront payments and large sum commitment fees before any proper procedures are carried out.

Conclusion

Every transaction is unique and the specifics of the case will determine and guide the type of questions to be asked and the places to look. Avoid hasty transactions with persons who hurriedly want to make you sign some contract or make payments.

1 Comment

Pasarqq

You actually make it seem really easy along with your presentation however I in finding this topic to be

really one thing that I think I might never understand.

It kind of feels too complicated and very huge for me.

I’m looking ahead for your next post, I will

attempt to get the grasp of it!