Sometimes, people are oblivious to the fact that a Not-for-Profit or Non-Governmental Organization (NGO) is also termed as a company limited by guarantee. A private company limited by guarantee is a form of business structure often used by non-profit organizations, clubs, co-operatives, social enterprises, community projects, membership organizations and charities to serve social, charitable, community-based or other non-commercial causes.

Not-for-profit organisations or Guarantee companies typically retain any surplus income for re-investment or use it to promote the non-profit objectives of the business rather than distribute profits to members. Most Not-for-profits / NGOs are not within the tax net of the central government. We are happy to share with you the procedures to follow as well as the requisites for registering a Non-Governmental Organization at the Registrar General’s Department.

Requirements for registering a company limited by guarantee (NGO / Not-for-profit)

- The name of the organization (at least 2 names for name search

- An official fee of four hundred and thirty Ghana Cedis (GH₵ 430)

- Address of company (digital address, building name, street name, house number, location or area)

- Tax Identification Number for Executive Council Members, Subscribers, and Secretary.

- Detailed particulars of Executive Council Members, Subscribers, and Secretary.

- Passport biodata pages of Executive Council Members, Subscribers and Secretary (For TIN, where applicable)

- Name and address of Auditors

- Auditor’s consent letter

What is the cost of registering an NGO / Not-for-Profit or Company limited by guarantee?

The total statutory cost for registering an external company in Ghana is 270 Cedis. This fee is payable directly to the Registrar General’s Department.

Procedures for registering a company limited by guarantee (Not-for-profit / NGO)

Applicants may purchase a set of prescribed regulatory documents and a set of form 3s from the Registrar General’s Department at GH₵9.50 or download all business registration forms online, http://rgd.gov.gh/index.php/forms/. To register a company limited by guarantee, these are the necessary steps that applicants must undertake;

· STEP 1 – Company name Search

A business name, also known as a company name, is simply a name or title under which an organization or other legal entity trades. If you want an exclusive right to that name, it is vital to do a name search of your intended name to check if a similar or identical name of an organization in your field does not exist before you can proceed.

In choosing the name for a Not-for-profit one must make sure that the name is;

- Meaningful– Does the name support the positioning and reflect the essence of the organization?

- Relevant– Is the name relevant to the key audiences you are trying to reach? ( target market, donors, volunteers)

- Distinctive- Does the name stand out from the names of other organizations in your community?

The RGD may reject names which in its opinion are too similar to existing names, misleading, offensive, and undesirable or violate existing trademarks. It is advisable to submit alternate company names. Be creative with the company names in order to avoid all being similar to existing company names or trademarks registered by the RGD.

· STEP 2- Apply for a Taxpayer Identification Number (TIN)

Applicants would be required to provide the TIN of the board members, subscribers and secretary. In case any of them do not have a TIN, there is a taxpayer identification number form applicants must complete in order to secure a tin.

Information required to complete an individual TIN form includes;

- Name of applicant

- Occupation

- Photo ID details

- Mother’s maiden name

- Residential and postal

- Contact of the applicant.

Please note that, for a Ghanaian applicant, you are required to add your Ghana card ID to the complete TIN form. Foreigners are required to attach a copy of the biodata page of their passport. For foreigners who do not reside in Ghana but intend to incorporate a company in Ghana, you must write a letter confirming that you live outside Ghana and stating your foreign address. It must be notarized by a notary public in the foreigner’s home country. The letter must be addressed to the Registrar of Companies.

· STEP 3 – Complete Company Limited by guarantee form 3B

Information required to complete the form 3B includes;

Form 3B – Private Limited by Guarantee

Information required to complete the form

- Company Name

- Nature of Business (Give a brief description of the company’s business activities

- Registered Office

- Digital Address

- House Number/Building or Flat Name

- Street Name

- City

- District

- Region

- Principal Place of Business

- Digital Address

- House Number/Building or Flat Name

- Street Name

- City

- District

- Region

- Other places of business if any

- Personal details of Executive Council Members, secretaries and subscribers (nationality, date of birth, occupation, contact, email and residential address)

- Tax Identification Number of Executive Council Members, Secretary and Subscribers

- Auditor’s details

- Form 26(A) – Consent to act as a company director form.

Section 172 (2)(b) of the Companies Act, 2019, Act 992 states that;

“ (2) A person shall not be appointed as a director of a company unless the person has, before appointment;

(b) Consented in writing to be a director and filed the consent twenty-eight days.”

iii. Form 26(B) – Consent to act as a company secretary form.

According to the Companies Act, 2019, Act 992, section 211(8);

“The Company Secretary shall, before assuming office, lodge with the company for onward transmission to the Registrar, the written consent to serve as a Company Secretary”.

Information required to complete this form

- Company Name

- Personal details of the secretary (Name, Residential Address, Postal Address, Mobile Number and qualification)

- Signature

- Date

- Form 26 (C) – Statutory declaration form.

This is a form that is required to be completed by the directors of the company to declare that the information provided is true.

According to the Companies Act 179, all companies are required to have at least two initial directors and a secretary during the company registration process. At least one of the company directors or secretaries must be a resident of Ghana.

- v. Beneficial Ownership Form

This form is to disclose the beneficial owners of the company. Complete BO1 and BO2.

Information required to complete the form;

- Purpose of Beneficial Ownership Information (You select “Company Registration)

- Company Information

- List of the Beneficial Ownership.

- Details of the Beneficial Ownership

- Type of Company

· STEP 4- Company limited by guarantee constitution form

Information is required to complete the regulations form.

- Name of company

- Nature of business

- Name & TIN of members of the Executive Council

- Address Description of the subscriber. This includes;

- Name

- TIN

- Date of birth

- Nationality

- Business occupation

- Postal address of the applicant

- Signature of applicant

· STEP 5-Submission of forms

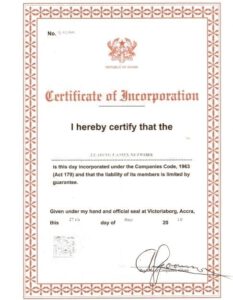

After completing the forms, an applicant should submit the forms together with the auditor’s consent letter to the office of the Registrar General Department with an official fee (in cash) of GH₵270. After successful registration, the applicant would be given a Certificate of Incorporation, Certificate of Commencement, Form 3, and the Company’s Regulations.

Licensing requirements for NGOs from the Department of Social Welfare

After registering the company with Registrar General’s Department, all NGOs are mandated to register with social welfare before the commencement of business. Below are the procedures for registration with social welfare.

Apply for NGO status at the Department of social welfare which is the regulator of NGOs in Ghana, by submitting five copies of each of the following documents to the Accra Metropolitan Assembly (A.M.A.) within the District where the NGO is located.

Required Documents for registration with Social Welfare

- Company registration documents including certificate of incorporation and commencement, form 3&4 and regulations (for companies in the old system) or Certificate of incorporation, form 3 and Constitution (for companies in the new system).

- Application letter on the organization’s official letterhead

- The organization’s constitution

- An NGO profile form

- Memorandum of understanding between the NGO and the Government

- Articles of incorporation from the country of origin (if it is an external company).

- A social investigation report

- A recommended letter from the district, municipal or metropolitan assembly responsible for the area where your NGO is to be located.

- Brochure or publication about your organization.

- The district office (A.M.A) after inspection and evaluation writes a report to the national or regional office by submitting 3 copies of an endorsement letter of the Department of social welfare.

What is the cost of registering an NGO with Social Welfare?

The official fee for registering a company limited by guarantee with the Department of Social Welfare is ¢1,200 for local NGOs and $1,500 for foreign NGOs who have their branches registered in Ghana.

Taxes for Companies Limited by Guarantee in Ghana

Unlike before, all companies limited by guarantee were excluded from Corporate Taxes and Value Added Tax (VAT). Currently, to qualify for an exemption, the company is required to write an official letter to the Commissioner General of Ghana Revenue Authority for the authority to assess, determine and if deemed necessary, grant the exempts based on the nature of business activities and where there will be any estimated profits or not from their operations. Where the Commissioner has established that the company or NGO is exempt, then the NGO is exempted from paying corporate taxes. Corporate tax is the tax imposed on the net income of the company, in other words, it is a levy placed on the profit of a firm to raise taxes.

Moreover, they are exempted from paying Value Added Tax (VAT). This is because Companies limited by guarantee do not have tradable goods and services that attract VAT. VAT is charged on the supply of goods and services in Ghana, imported goods and the supply of imported services at a rate of 15%. In a case where the NGO starts to engage in buying and selling, the company is obliged to comply with the law and pay tax as the law demands. In other words, it does not become NGO anymore since the activity does not include trading for profit.

However, all Companies limited by guarantee are mandated to pay income taxes on the earnings of their employees. Thus Pay-As-You-Earn is commonly termed PAYE. In Ghana, tax is deducted from an employee’s personal income at source through a ‘pay-as-you-earn’ scheme. The highest income tax rate payable by an individual resident in Ghana is 25%.

It is the employer’s responsibility to file monthly tax returns on behalf of its employees. The employer is required to withhold the employee’s taxes and pay to the Ghana Revenue Authority. The tax withheld must be filed and payment made by the 15th of the month following the month in which the tax was withheld. Failure to do so attracts a penalty.

In order not to be caught up with the law, Investors, businessmen and all charity organisations who wish to set up a business or company in Ghana must endeavour to comply with all the laws of Ghana. This adds up to the credibility of the individual and the company as a whole.

NGO as a Corporate Shareholder of a Company Limited by Shares

Most people know that both companies and individuals can have shares in a company. Surprisingly, most people do not think Non-Governmental Organisations can be corporate shareholders in a limited liability company. I guess this is because NGO is notably a non-profit making company so it is quite interesting for an NGO to have shares in a profit-making company. The fact is, Yes! An NGO can be a corporate shareholder in a limited liability company. However, the law mandates that the profits accrued from the business operation of the company of which the NGO holds shares would be ploughed back or reinvested in the business to promote the objectives of the NGO.

Annual General Meetings for Company Limited by Guarantee

Under section 149 of the Companies Act – ‘Except as provided in subsection (3) of this section, every company shall in each year hold a general meeting as its annual general meeting in addition to any other meetings in that year, and shall specify the meetings as the annual general meeting in the notices calling it; and not more than fifteen months shall elapse between the date of one annual general meeting and the next;

Provided that, so long as a company holds its first annual general meeting within eighteen months of its incorporation, it need not hold it in the year of its incorporation or the following year

Filing Annual Returns for the Company

As required by section 122 of the Companies Act, of 1963, all registered companies are to file annual returns each year, after 18 months of incorporation.

Section122. (1) states- Every company shall once at least every year, deliver to the Registrar for registration of an annual return, including particulars of every member of the company, and in the form and relating to the matters prescribed in the third schedule to the companies code;

(2) The annual return shall be completed within forty-two days of the date on which the statements, accounts, and reports of the company are sent to the members and debenture holders under section 124 of this code, and shall be signed by a director and the secretary of the company.

The fee for Annual Returns filing for Non-Profit Organization is GHS90.

- Download and Complete the Annual Returns Forms from here https://www.rgd.gov.gh/forms.html.

- Audited Financial Account for the Year

- Filing fee (GHS90)

Changes after Registration of Company Limited by Guarantee

After registration of a company, the subscribers may choose to make amendments like a change of business address, directors, change of subscribers, change of business name, activity etc. All these amendments must be done by the Registrar General’s Department.

There are forms to be completed depending on the nature of change and written resolutions prepared by the company secretary, dully signed by both subscribers and directors. For a Change of directors, both resignation and acceptance letters from the old director and new director respectively must be attached.

Can an NGO be converted into a Company Limited by Shares?

Converting an NGO into a company limited by shares is allowed and can be done at the Registrar General’s Department. Aside from the change in company regulations and possibly the nature of activity at the Registrar General’s Department, there are other tax compliances that the company would have to comply with to operate as a profit-making company. Depending on the new nature of the activity, the new company may be required to comply with other regulatory compliances.

According to the company code, Act 179, section 10

1) A company limited by guarantee may not lawfully be incorporated with the object of carrying on business to make profits.

(2) If any company limited by guarantee shall carry on business to make profits, all officers and members thereof who shall be cognisant of the fact that it is so carrying on business shall be jointly and severally liable for the payment and discharge of all the debts and liabilities of the company incurred in carrying on such business, and the company and every such officer and member shall be liable to a fine not exceeding five pounds for every day during which it shall carry on such business.

Conclusion

The registration process is fairly easy and not significantly different from other forms of business registrations in Ghana.

We will be happy to facilitate the registration process of your not-for-profit organization in Ghana and help you acquire all necessary licensing to commence business.

Let us know what your experiences have been in starting a not-for-profit in Ghana.

75 Comments

Abdallah Issah

Very insightful.

Daniel Forson

Hi, I want to start an NGO. I want your outfit to facilitate the process from start to finish. How much will I be charged

Richard Darfour

Please what is the article of incorporation about? And also which department of government do you need to go and sign this memorandum of understanding. What is contained in NGO profile form.

UNRO Organization

Dear all

We have started Activity as a Non Government Organization in Afghanistan by the name of Universal Necessity Relief Organization (UNRO) and execute services and Activity in different sections. We are just work for the prosperity and Dignity of Society and people. This organization not a part of political and religious bounds.

We are serving country, society and people, in Agriculture, Healthcare, Education and Social services p. especially we want to prepare trainings of capacity building for women and those children who are poor, street walkers, Vulnerable not have food to eat and are not access to school or education. We are hopeful that can provide programs for them in the parts above named to build their future and could manage their future life normally without any distinction with men and other children and could promote their Economy.

We want to upbringing the Talents and build capacities to build Afghanistan and a modern and literate Society. So want to get funds from different Organizations and donors and follow their programs step by step by high circumstances or quality and doing excellent management. And want to give commodious distribution to women that could get a part in development of Economy and rebuild their country together with men and in other aspect make facilities for their life and not needy for cooperation of the men and others. In this way can promote and help with women and children to promote their lives and can restrain them from violence and it would be opportunity to prepare and provide a good life for themselves.

Amenu Godson Andy

I think the process is quite okay,will come in shortly and register my NGO

Clara Ampadu

I would like to register an LLC non-profit medical clinic.

There are 3 members who need TIN.

What is the cost and what forms are required?

Dechi Kwabena Samuel

Please how do I start, I need an NGO registered.

Kindly give me the details in my inbox so I’ll be able to operate legally

Munira M

Very useful information. It really narrow done the work for me.

Andy

Please my suggestions is if the auditors are two in person how much will the total amount cost. And please after paying the 270ghc will you add additional money to the registrar. Thank you

ANSELM ARTHUR

Please I would like to visit your office for assistance on gathering documents needed for licensing under social welfare.

Isaac Osei-Akoto

If my NGO brings an automobile/a car/a vehicle into Ghana, does it clear it for free as part of the benefits of an NGO? or are there charges applied?

Thanks,

Isaac Osei-Akoto

Kwame Israel

Very helpful and relevant article. Cheers

okunka blankson

good and straight forward

george blankson

Useful information for new support initiative like ours in korlegonno mamprobi chorkor area.

Jeramy Purton

Hi there firmusadvisory.com

Need a dependable merchant account for your import/export business?

With over 20 years of experience, EthosPay makes credit card processing easy for all types of golf product businesses.

Get Pre-Approved Fast and Start Processing in 72 Hours,

Apply Online: http://bit.ly/your_import_export

Regards,

EthosPay

UNSUBSCRIBE or REPORT SPAM

http://bit.ly/Remove_Your_Site

Danny Achala

Very helpful. ….. However I urge you to provide a sampled filled registration form to further guide people.

GM Shahid

I m from Pakistan is willing to establish NGO for the underprivileged people to help them stand on their feet. What shall I require to move forward.

okunka blankson

Useful and helpful

Jonathan Nyarko-SIAW

Very insighrful. Can I register a church by this process and who qualifies as the director (s).

Godwin Ari-Pakings

I have really been enlightened about this process and thumbs up for you

Abdul Wahab Nurudeen

Naaaaa……..main aim is to help the vulnerables and why this complex process

Jacob Hogbah

So helpfull this information should be made public in the dailies and any other medium available to save us from this cloudy situation

Frank Adjei

Very insightful and simple. Would get mine registered soon. Thank you

Sylvester Dadzie

Useful information

Sampah owusu

Great. I appreciate the info

YAW AGYEMAN

Very informative and instructive!

Anthony Cobbinah

Very useful and easy to understand.

Bless you!

Alexander Charway

I will be glad if I can be assisted with a soft copy of the registration forms for NGO. Thank you.

Emmanuel Newman

Wow you guys are the best.! God bless you

Mavis Dzikunu

Nice and great information

Narh-Paddie William

Very adequate and informative. But may I ask:

What documents does an NGO has to file with the Ghana Revenue Authority?

Frank Yao Bediako Agbo

Changes after Registration of Company Limited by Guarantee

After registration of a company, the shareholders may choose to make amendments like change of business address, directors, change of subscribers, change of business name, activity etc. All these amendments must be done at the Registrar General’s Department. Thanks for that.

There are forms to be completed depending on the nature of change and written resolutions prepared by the company secretary, dully signed by both subscribers and directors. For Change of directors, both resignation and acceptance letter from the old director and new director respectively, must be attached.

What about the case of death, where the old Director died and is no more there to sign? No comment about it or legislature addressing the issue of death of a Director? We want to know what should be done especially about both signature issue as the old Director is no more there to sign?

Yandam Labaar

How would I check if a company is registered under company or NGO ?

Sharif Salman

In fact, this is helpful. We registered our NGO in 2017 with the Registrar General Department but we did not know there were still a lot of processes to be covered. We had started work after the registration but we have never returned to the Registrar General Department to submit our annual returns. Though it is from our own contributions.

Please help us. Have we committed an offence? How much would that affect us? What is the way forward?

Thank you.

Nanakodwo

I believe the 18 months grace period for filing your first returns after incorporation applies to companies limited by Gurantee(NGOs) as well?

Hannah Tawiah Whajah

I’m very grateful for the information, I will come and register mind.

Tsatsutsui

Great. However, I will like to see further details on the registration of an association formed for the betterment of the people of a particular town or village. Are the terms the same as NGos?

Henry Lee Sackey

Dear Sir/Madam

I would like to register our area, Land Lords Association. Are we also paying the 200 Ghana Cedis?

Thank you.

White-Shalom Solomon

Very useful and will soon be registering my company

Idris Yakubu

Very useful thanks

Edward

Surprisingly, most people do not think Non-Governmental Organization can be a corporate shareholder in a limited liability company. I guess this is due to the fact that, NGO is notably a non-profit making company so it is quite interesting for an NGO to have shares in a profit making company. The fact is, Yes! An NGO can be a corporate shareholder in a limited liability company. However, the law mandates that the profits accrued from the business operation of the company of which the NGO holds shares would be ploughed back or reinvested in the business to promote the objectives of the NGO.

Does this means that my NGO can engage in profit business but ensures that the profits go to benefits the objectives of the NGO right?

Can I get clarifications?

Nii Okoe

Very helpful. Thanks

ADJEI SERWAA ABIGAIL

Great! This article contains all that I was looking for. Thank you for such information.

But I want to know, do you necessarily need an office before you register your NGO?

David Bampoe

Am about starting but do not have a place of an office and also I want to know how many people should constitute the Executive Council Members. What of if their not up to the said number and otherwise if I have none. Doesn’t it mean I can’t register???

Juliana Amoateng

Very detailed and insightful!

Abigail Oppong

Please i want to be clear with the cost of registration. A friend said she paid about 470. Cedis instead of 270.00.

So which is which

Gbetormenyo Athanasius

Useful and helpful to become NGO

Mr. Adjei

Very insightful. My workload has actually been reduced by this information. Much grateful.

Charles Parker

Wow…this information is very useful and has given me insight about how to register my NGO because it was a challenge for on where to start. Thank you for this information.

Jaceline

very useful, thanks

Maxwell Kwapong

This is very great article

G M Shahid

We have already got a Non-Profit microfinance Shria based Institute in Accra, needing advice and services for its kick start.

Abossey Naa Faustina

Any number to call on please

Firmus Advisory

Hello Faustina, kindly call 0572805778 for further assistance. Cheers!

555-666-8989

Hello, I have Non-4-Profit… I am seeking to establish business in your country. Your information is quite useful. (We do not have a phone line in operation)

Firmus Advisory

Hello, thank you for the feedback. One of our staff will get in touch with you. Thanks.

Samuel

Hello, please I want to establish an NGO.

How do I go about the registration?

Firmus Advisory

Our compliance team will revert soon, thank you.

Asamoah George

Good Evening,

Please I really want your company to help me register my foundation, please let’s keep in touch.

Firmus Advisory

Our compliance team will revert soon. Thank you

Juliet Amartey

Is it possible to register the business under NGO ?I made a mistake by registering under sole proprietorship.

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Abu Bawa

I am from Konongo and I have an organization called Ashanti Akim Village savings and load Asso

ciation, and I want to register it . So what should I do , should I go to cooperative organization to register or Ghana register general. my email address is [email protected]

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Collins Adade

Hello please I want to Register an NGO

Please how do I go about it and the owner of the organization is not here in Ghana ,thank you

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Evans

Thanks a lot for this useful information.

My question is do I need an office and a location before I can register my NGO?

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Pastor Samuel asante

Dear Sir/Madam my name is pastor samuel Asante. I want to register NGO please l need more information

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Mohammed Kamil Umar

Dear Sir/Madam.

I’m Mohammed from Ghana I want start an NGO and I need more information please.

Thank you.

Firmus Advisory

Thank you for your query our compliance team will attend to you. Thank you

Maku Maulehano

Thanks for the information. Please how much will it cost me overall to register an NGO in Ghana?

Nana Amofa

I’m outside ghana and I need to the know if you assist me to register an NGO in ghana .

Thanks

Content Firmus Advisory

yes please. We can. We can register your NGO with the RGD and also help you with your Social welfare registration with the department of social welfare. Kindly reach out to Edmund – [email protected] or on whats app +233 57 646 1118